xReality Group Limited (“XRG” or the “Company”) is pleased to present its Preliminary Final Year Report.

Dividends

No dividends have been declared or are payable for the year ended 30 June 2024.

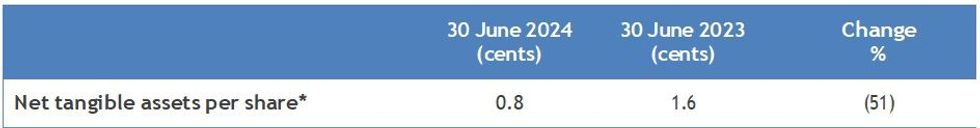

Net Tangible Asset Information

*Derived by dividing the net assets less intangible assets attributable to equity holders of the Company by the total ordinary shares at 30 June 2024 (553,139,337) and 30 June 2023 (446,346,595) respectively.

Please note that throughout the financial year the company has increased its intangible assets by $2.1m and increased its intangible liabilities (deferred revenue) by $2.6m, both of which are subtracted in calculating the Net tangible assets.

Commentary and results for the year

Delivering on Strategy and Outperforming Expectations

XRG's achievements in FY24, particularly in validating and expanding the Operator XR software products, underscore a pivotal year of strategic execution and market penetration. The company not only met but also surpassed its strategic milestones, demonstrating effective growth management and the appeal of its innovative solutions in global markets. This success has set a strong precedent for continued growth and innovation throughout FY2025 and beyond.

Enterprise Sector

Throughout FY2024, xReality Group Limited made substantial strides in expanding its customer base for the Operator XR platform. The year saw a marked increase in new customers, particularly in the U.S. and Australian markets.

The company is using 3 key indicators to track its success in the new sector; Total Contract Value (TCV), Annual Recurring Revenue (ARR) and total customers world-wide.

For FY2024 our TCV was $4.1m, an increase of 193% on FY23 (FY23 $1.4m). The ARR grew by 505% from $365k to $2.21m, and by the end of the financial year we had 29 customers around the world including Law Enforcement agencies, Military Units, Education and Training agencies and other government agencies.

Key Markets Penetration

The two key markets of focus have been Australia and the United States. Sales efforts have been concentrated on these markets.

In the first half of the year, the company focused on expanding its U.S. operations. Initial market engagement involved trade shows and selective customer interactions, leading to the establishment of a permanent Sales team and Operations unit and securing its first law enforcement client in Colorado. This early foundation paved the way for an extremely successful second half of the year where the company added a further 24 customers in the US across law enforcement and training organisations.

The success in North America has also carried through to the Australian market, with a major contract awarded by a state government agency in late June with a TCV of $810k (signed 3rd July). This State Government sale and a further Australian military sale valued at $317k ended the financial year contributing significant ARR into FY25 and beyond.

Other Global Opportunities

In parallel with the direct sales strategy in Australia and the US, Operator XR has now established a distributor network in S/E Asia and Europe through partnership agreements to market, deliver, and support Operator XR products and software into those regions. These arrangements are expected to commence to deliver sales in FY25.

Click here for the full ASX Release

This article includes content from xReality Group, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

https://ift.tt/Opn9oh7

_300xx250.jpg)

0 댓글