Augustus Minerals (ASX: AUG; “Augustus” or the “Company”) is pleased to provide an update on geological modelling of mineralisation and alteration mapping following recent RC drilling and reprocessing of historic IP survey data for the Minnie Springs Copper (Cu)-Molybdenum (Mo) project in the Gascoyne Region.

- Augustus Minerals has conducted re-processing of historic Induced Polarisation (IP) geophysics at the Minnie Springs Cu-Mo porphyry project which highlights the potential for near surface extensions to existing Mo mineralisation.

- Potential identified for higher grade Cu and Mo zones at depth below “tilted” porphyry model.

- Cu mineralised quartz veins drilled by Augustus in the 2024 RC program over the eastern part of the prospect may be “smoke” remobilized from higher grade zones at depth by shearing related to the regional Minga Bar fault system.

- Previous drilling at Minnie Springs intersected mineralisation, geology and alteration halo consistent with the zoning of a large porphyry copper / molybdenum system.

- Two holes with EIS funding planned to test for the higher-grade zones at depth.

Andrew Ford, GM Exploration

“Modelling of the Minnie Springs system in an integrated manner by incorporating recent drilling, alteration mapping and geophysics has highlighted both potential extensions to existing near surface Mo rich zones, as well as the potential for higher grade Cu-Mo zones at depth”.

Minnie Springs

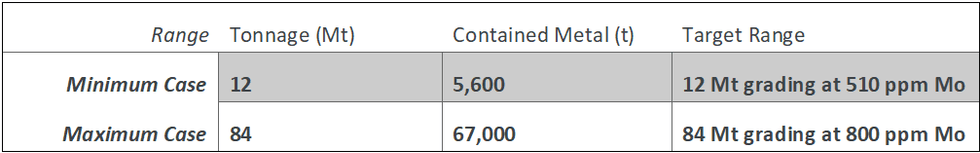

Minnie Springs hosts porphyry related Cu-Mo mineralisation that was previously drilled by Equatorial Mining and Catalyst Metals. A molybdenum Exploration Target has previously been defined by SRK Consulting for the historic drilling area comprised of between 12 - 84Mt as outlined below (Table 1 and Figure 2)1. Clarifying Statement: The potential quantity and grade of the exploration target is conceptual in nature, there has been insufficient exploration to estimate a Mineral Resources, and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

Table 1. Exploration target size estimate for Minnie Springs Molybdenum depositNote: Based on ~300 ppm Mo cut-off at 100% recovery.

Table 1. Exploration target size estimate for Minnie Springs Molybdenum depositNote: Based on ~300 ppm Mo cut-off at 100% recovery.

The recently completed 3,070m RC drilling program that infilled around hole MSRC012 drilled last year (18m @ 0.37% Cu and 9.7 g/t Ag from 94m downhole, and 16m @ 0.38% Cu and 19.4g/t Ag from 121m downhole2) and tested the northern half of the 2km long copper-in soil anomaly continued to extend the footprint of Cu anomalism. Assays from this program >0.1% Cu are Listed in Table 2 below; collar details are listed in Table 3.

The RC drilling has confirmed strong Cu anomalism within quartz veins over a strike length of greater than 3km beneath the strong Cu-in-soils anomaly (Figure 2). The association of the copper with the quartz veins with moderate to low levels of pyrite (no chargeability IP response) suggest structural remobilisation from a deeper copper source. Shearing within the Cu zone increases significantly as it approaches the major northwest trending Minga Bar Fault system; this is supported by a marked increase in water intersected within the RC drilling within the easternmost holes.

As discussed above, the Mo rich core of the system is located southwest of the Cu anomaly which implies that the system is tilted to the east, exposing the Mo rich zone which is usually seen deeper within the porphyry than the Cu zone.

Geophysics

Southern Geoscience Consultants (SGC) reprocessed the two IP Surveys conducted by Equatorial Minerals in 1997. A gradient array survey was conducted over both the Mo and Cu zones, highlighting elevated chargeability over the Mo rich zone, with no significant chargeability over the Cu-in-soil anomaly to the east. The chargeability anomaly over the Mo mineralisation appears to be reflecting a combination of disseminated pyrite and molybdenite observed in the historic drilling (Figure 3).

Click here for the full ASX Release

This article includes content from Augustus Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

https://ift.tt/aKHy0iM

_300xx250.jpg)

0 댓글