Energy is the lifeline of global economic growth, today and into the future. While renewables are gaining market share, oil and gas continue to dominate the energy sector.

Read on to learn more about what happened in the oil and gas market in 2023 and what’s expected for 2024.

How did oil prices perform in 2023?

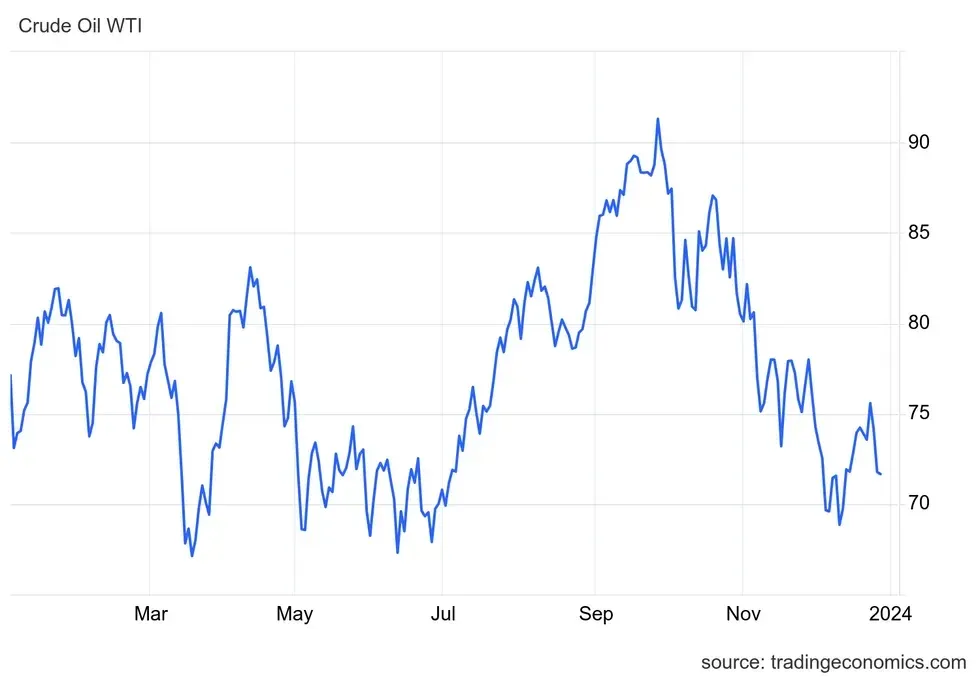

As Putin pushed his troops to war in Ukraine, supply side uncertainty sparked a significant spike in oil prices in 2022, reaching as high as US$120 per barrel in June. However, any expectations of a longer-term elevated price environment soon evaporated in 2023.

In the first half of 2023, the specter of a looming global recession began to emerge and a bearish sentiment pervaded much of the oil and gas market. Oil prices traded between US$67 and US$83 during the period, while natural gas prices reached a 2023 low of under US$2.50 per million British thermal units in June. Depressed pricing led to lower US production, according to Reuters, from an average of 780 rigs drilling for oil and gas at the end of 2022 down to 687 in June of 2023.

Eric Nuttall, partner and senior portfolio manager at Ninepoint Partners, told INN in an interview that given the tightness in global inventories at the start of the year, his firm was looking to US$100 per barrel for oil to close out 2023. The closest oil prices got to this level came after a rally in the third quarter that saw a jump of more than 30 percent by the end of September, despite concerns over weak economic indicators.

Nuttall attributes this Q3 price spike to a “sharp contraction” in global oil inventories, which he reports are at their lowest levels since at least 2017. “At the same time you have OPEC [Organization of the Petroleum Exporting Countries] that is very clearly in the driver seat where they are balancing the market by withdrawing further exports,” he added.

In September, Saudi Arabia extended its voluntary crude oil production cut of 1 million barrels per day (bpd) through December. At the same time, Russia said it planned to extend its 300,000 bpd export reduction until the end of the year as well.

However, oil prices returned to a downward trend in the fourth quarter of 2023 even as a new conflict broke out in the Middle East between Israel and Hamas.

“Volatility is feeding negativity to a point to today where you look at net speculative length, which is our measurement for optimism towards oil, we’re now almost at its lowest level in history,” explained Nuttall in the December 2023 INN interview.

How did natural gas prices perform in 2023?

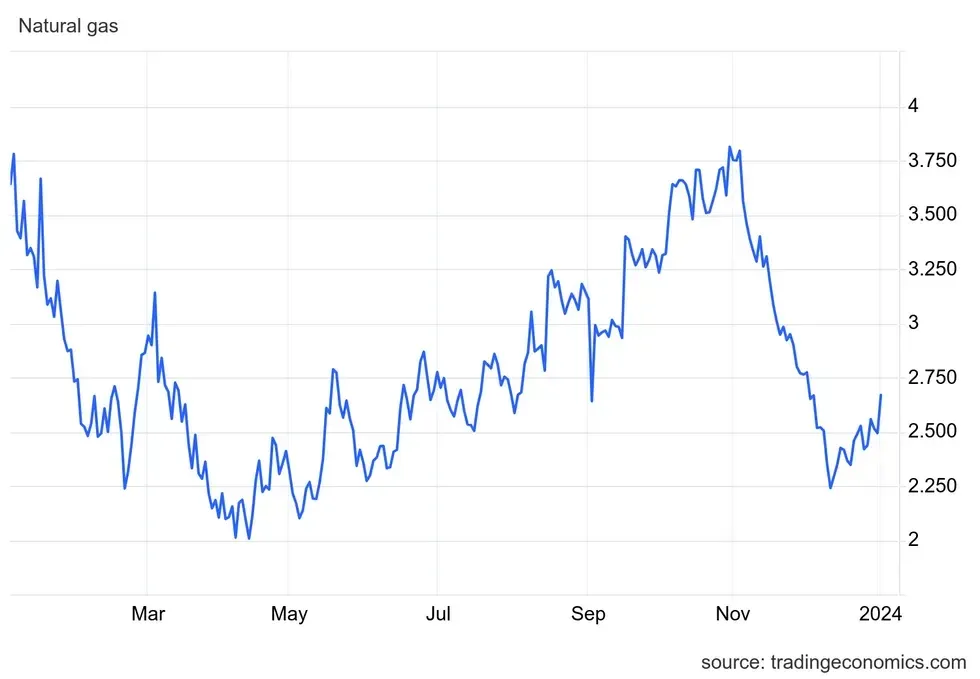

"The energy crisis triggered by Russia’s invasion of Ukraine marked a turning point for global natural gas markets," stated the International Energy Agency (IEA) in its Medium-Term Gas Report 2023.

"While market tensions eased in the first three quarters of 2023, gas supplies remain relatively tight and prices continue to experience strong volatility, reflecting a fragile balance in global gas markets."

In early November 2023, natural gas supply exceeded forecast demand headed into what was expected to be a milder winter season, which led to a more than 46 percent drop in prices.

"High storage levels in the European Union allow for cautious optimism ahead of the 2023-24 heating season," noted the IEA in its report. "However, a range of risk factors could easily renew market tensions. Northwest Europe will have no access this winter to two sources that used to be the backbone of its gas supply: Russian piped gas and the Groningen field in the Netherlands."

Mild to wild winter conditions sent natural gas prices spiking again in mid-January as bitter cold Arctic air led many in Northern climates to crank their thermostats while at the same time as supplies "sharply declined due to frozen wells caused by extreme cold," reported Trading Economics.

How will conflict in the Middle East impact oil and gas?

With 2024 already under way, volatility is still dominating the oil and gas market story with geopolitical conflict raging in the Red Sea.

Despite this volatility, the US Energy Information Administration (EIA) expects Brent crude oil to average US$82 per barrel this year, the same average oil price experienced in 2023. “Our forecast for relatively little price change is based on expectations that global supply and demand of petroleum liquids will be relatively balanced,” stated the EIA in its Short-Term Energy Outlook report released January 9.

Yet, the EIA advises its price forecast remains uncertain. One of the factors feeding into that uncertainty are “unplanned production disruptions, a risk highlighted by the recently escalating tensions in the Red Sea”.

What began in November 2023 as Houthi militia attacks on international commercial ships in response to the Israel-Hamas war, has as of mid-January become a hot point in the ongoing cold war between the US and Iran. Hence, oil tankers are steering clear of the Red Sea–one of the most important maritime trade routes in the world. This not only increases the cost of shipping oil products, but also results in delivery delays. These events have already resulted in oil price spikes of as much as 2 percent in the first few weeks of the year, and could disrupt markets further as tensions continue to play out in the region.

“Increasing conflict in the Middle East is a potential driver to higher oil prices if production or transportation facilities are damaged,” Craig Golinowski, president and managing partner with Carbon Infrastructure Partners, told INN via email. “In the past several years, direct attacks on Saudi oil and gas facilities in the Red Sea have occurred.” Since 2014, Saudi Arabia has been fighting Iran-backed Houthi rebels in Yemen.

“Given most of the global spare oil production capacity is in Saudi Arabia, any damage to Saudi facilities could cause the market to experience a significant change in its view on geopolitical risk,” said Golinowski. However, in his January 12 email he did emphasize that for now “the market appears to remain very unconcerned about geopolitical risk disrupting oil and gas supplies.”

At the World Economic Forum on January 16, Saudi Arabia’s foreign minister Prince Faisal bin Farhan Al Saud said a top priority for his nation is securing a ceasefire in Gaza, which his government views as the only way to end the Red Sea attacks, reported Reuters.

If the conflict in the Middle East spreads in the region, Golinowski notes that Saudi-led OPEC could be faced with a situation whereby it must react if one or more of its member producers become involved or targeted.

OPEC to play an outsized role in 2024

A much larger factor influencing the market this year will of course be OPEC’s commitments to continuing production cuts.

In November, OPEC members signed an agreement to lower crude oil production targets by an additional 2.2 million bpd through March 2024 in response to weaker crude oil prices. “These cuts are in addition to the existing voluntary cuts and lower production targets set at its June 2023 meeting,” according to EIA analysts.

“One of the stated goals of OPEC is to reduce market volatility and that’s been tough in 2023,” Nuttall told INN. He explained that OPEC’s production decisions are based on the fiscal needs of its member nations. Saudi Arabia, for example, has massive growth and modernization plans to provide for its younger population, which doesn’t align with an oil price of US$75 per barrel. “As a revenue maximizer, we think OPEC is practicing value over volume. Cut volume to increase value to drive a higher oil price.”

The EIA is forecasting crude oil production out of OPEC and its partners (OPEC +) will average 36.4 million bpd in 2024, which the agency notes is less than the 40.2 million bpd average produced over the pre-pandemic five-year period (2015–19). At the same, the EIA expects to see a slowdown in non-OPEC+ production growth from the 2.5 million bpd increase in 2023 to only 1.1 million bpd of growth in 2024. This is seen to be primarily driven by slower growth in US oil output from an extra 1.6 million bpd in 2023 to only an additional 0.4 million bpd in 2024.

As for global oil consumption, EIA is projecting an increase of 1.4 million bpd in 2024, slightly lower than the 10-year pre-pandemic average. One of the factors decreasing demand for oil moving forward is the growing adoption of renewable energy technologies in the transportation sector, notes the agency: “We expect continued adoption of EV and hybrid vehicles will displace some motor gasoline consumption.”

Looking over to natural gas, the EIA is forecasting that the Henry Hub spot price will average between US$2.60 per million British thermal units (MMBtu) and US$2.70/MMBtu in 2024, up by about 10 cents/MMBtu over prices in 2023. “Record natural gas production and storage inventories that remain above the 2019–2023 average mean that natural gas prices in our forecast are less than half the relatively high annual average price in 2022,” stated the agency.

Opportunities in oil and gas stocks

So where should investors look for opportunities in the oil and gas market?

Many analysts are eyeing Canadian oil and gas stocks given the forthcoming startup of activities at the Trans Mountain Express pipeline expansion and the Coastal GasLink project in Western Canada.

“Oil and gas producers in Canada represent a compelling value with new oil pipeline and LNG infrastructure coming on-line to support production volume growth in 2024 and 2025,” said Carbon Infrastructure Partners’ Golinowski.

For his part, Ninepoint Partners’ Nuttall favors Canadian mid-cap oil companies. “That’s where you’re finding the most profound value,” he said. "We remain convinced that there remains an unbelievable opportunity in these names, especially with sentiment now at almost historic lows. We go through these bouts ... unfortunately this sector is volatile. To compensate you for that volatility we still see very meaningful upside in these names. And we remain bullish.""

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Elixir Energy and Helium Evolution are clients of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

https://ift.tt/PojwOnp

_300xx250.jpg)

0 댓글