Zinc started the year in a strong position coming out of a 2022 that saw the metal come close to all-time highs when it reached US$4,434.50 per metric ton on April 19, 2022.

However, zinc, the vast majority of which is used in alloys and for galvanizing other metals, fell in H1 alongside a rout of the base metals market. While smelting and supply issues from 2022 supported the price early, weak demand, particularly due to slower recovery in Chinese industrial sectors, caused zinc to move from undersupplied to oversupplied by the end of the year.

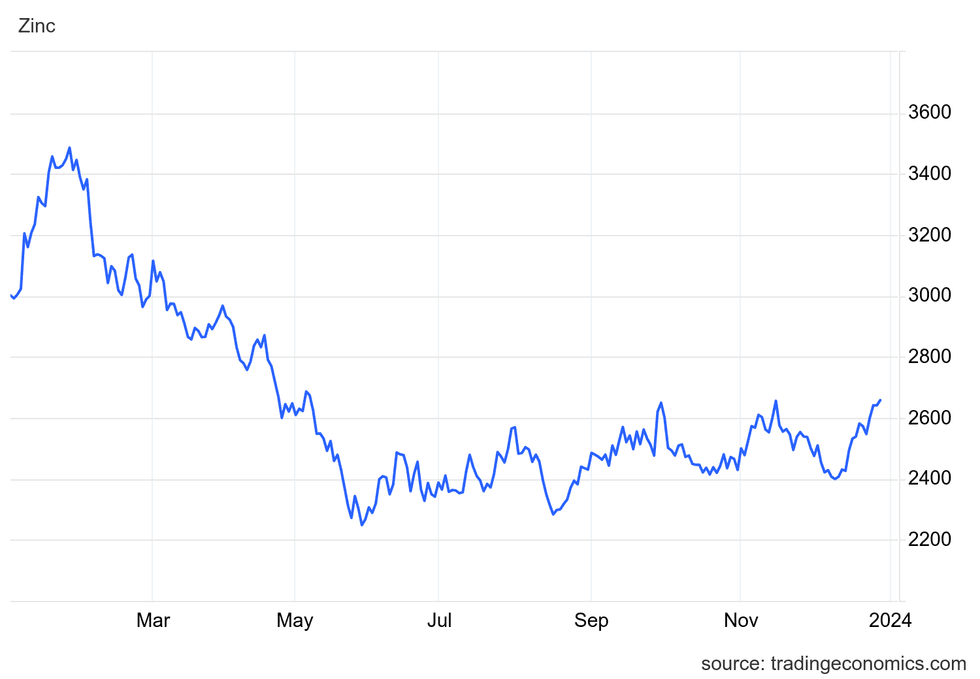

The metal faced less volatility than it did in 2022, falling through much of the first half of the year, before remaining largely range bound through the second half.

What did the price of zinc do in 2023?

H1

2023 opened with the metal continuing to face tight supply constraints in part due to Russia’s invasion of Ukraine, keeping zinc prices elevated. Weak demand was offset by bottlenecks in Europe where smelters had been working at reduced capacity due to high energy prices caused by the ongoing conflict.

After starting the year at US$3,002.00 on January 3, the price rose quickly in the first month of the year and reached its 2023 high of US$3,486.50 on January 26. This price increase came on the back of stockpiles at the London Metals Exchange reaching a three-decade low of under 20,000 metric tons (MT), falling from 80,000 MT in July 2022. This was far lower than in 2006 when the price of zinc reached a record high of US$4,442 amidst stockpiles of 110,000 MT.

The International Lead and Zinc Study Group (ILZSG), an intergovernmental organization of government officials and industry experts, forecast in October 2022 that zinc would face a deficit of 150,000 MT in 2023. However, by Q2 2023, the group had revised its forecast to a more marginal deficit of 45,000 MT.

This was brought on by a slumping real estate sector in China, which affected the broader base metals markets and lowered demand for all steel products. It was also impacted by European energy prices as they hit 18 month lows, allowing for better economic conditions and the resumption of smelting operations, increasing supply.

Falling demand and rising supply added downward pressure to the price of zinc, dropping it to US$2,248.50 on May 31 — its lowest since September 2020 and ultimately its low point for 2023.

The combination of low prices for zinc along with high mining costs caused Boliden (STO:BOL) to place its Tara zinc mine in Ireland on care and maintenance on June 13. Tara, the largest zinc mine in Europe, produced 198,000 metric tons of concentrates in 2022, and its output feeds the company’s Odda zinc smelter in Norway. The announcement of Tara’s closure caused the price of zinc to jump 5 percent on the LME that day to US$2,491.

H2

Despite the suspension at Boliden’s facility and small gains in the zinc price that saw it reach US$2,569 on August 1, markets were already shifting from undersupply to oversupply. Stockpiles at the LME reached 145,975 metric tons by the middle of August — doubling their mid-July stockpiles in just a month's time — which pushed the price back down to US$2,283.50.

Some of this excess in supply came from Citigroup (NYSE:C), which purchased large quantities of zinc and cut a rent-share deal to store it at LME warehouses in Singapore. The move allowed Citigroup to capitalize on the premium for storing zinc on LME warrants and bolster its portfolio through a metals-financing strategy that wasn’t possible when supply for zinc was tighter. The group extended its position throughout Q3 and Q4 with further purchases. While Citi has been tight-lipped about the specifics of the deal, insiders told Bloomberg that Citi has accrued a position in the 40,000 MT range.

Zinc prices rebounded through the second half of August and into September to reach a Q3 high of US$2,649.50 on September 29, and remained range bound between US$2,400 and US$2,660 through Q4.

In its last update for the year released in December, the ILZSG reported that through the first 10 months of 2023, supply for zinc had outstripped demand by 295,000 MT, moving what was projected to be a deficit at the start of the year to a surplus at the end.

The continued depression in zinc prices in H2 caused further temporary closures of mining and smelting operations. Private company Almina-Minas announced it would be putting closing its Aljustrel zinc-lead operation in Southern Portugal on care and maintenance from September 24 until mid-2025 in part due to low pricing in the market. This was followed by news that Trafigura subsidiary Nyrstar (LSE:0RH8) would suspend operations at the end of November at its two zinc mines in Tennessee, US.

The price of zinc closed out 2023 at US$2,658 on December 29.

Investor takeaway

2023 was a relatively lackluster year for zinc. High interest rates, an inflationary environment and a sputtering Chinese economy provided for the perfect storm to stall demand for the metal. Meanwhile, supply remained high, causing zinc to be the second worst performing metal on the LME after nickel. However, Citigroup's move in the middle of the year to take advantage of low prices and high supply brought a surprise factor to the market.

Temporary closures in 2024 will constrain supply, but it remains to be seen how prices will be affected and when demand will pick up and close the gap.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

https://ift.tt/7yRcCM0

_300xx250.jpg)

0 댓글